After we hear the phrase "insurance plan," what concerns brain? For most, it’s a fancy world stuffed with baffling conditions, fine print, and seemingly limitless choices. But at its core, comprehension insurance coverage the basics is actually about preserving what issues most to you: your wellbeing, your property, your income, and your lifetime. Whether or not you’re a younger Grownup just beginning or an individual planning to review your coverage, recognizing the basic principles of insurance coverage is very important.

Imagine insurance policies as a safety net, a way to safeguard by yourself against unexpected fiscal burdens. Life includes a way of throwing curveballs, and when disaster strikes, insurance policy may help soften the blow. But how just will it work? To begin with, insurance plan is usually a contract in between you and an organization. You pay out them a daily amount of money, called a premium, and in return, they promise to cover certain costs if something goes Improper.

At its simplest, the intention of coverage is always to share the danger. Let’s say you go into a vehicle incident. As opposed to paying for each of the damages outside of pocket, your vehicle insurance provider ways in to protect most or every one of the costs. In essence, coverage pools methods from quite a few people today, encouraging Everybody shoulder the economical load in instances of require. This idea of shared hazard is the inspiration of virtually all insurance policy guidelines.

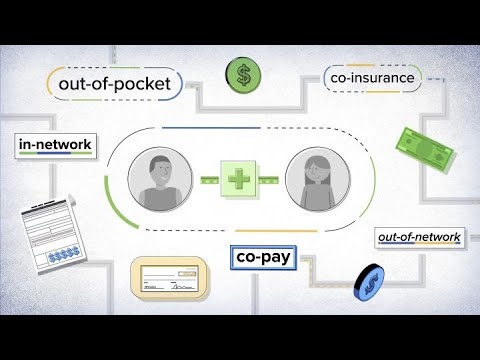

There are numerous sorts of coverage, Every single designed to safeguard diverse components of your life. Health coverage, by way of example, aids include medical fees, even though homeowners insurance shields your property from damages like fires, floods, or theft. Lifetime insurance gives money protection for your family during the party of your respective passing. Vehicle insurance plan, given that the name suggests, covers the costs affiliated with vehicle accidents or damages to your automobile.

Some Known Factual Statements About Understanding Insurance The Basics

Among the initial factors to be familiar with is how insurance plan premiums are calculated. Insurers acquire numerous variables into account when deciding the amount you’ll fork out every month. For health and fitness insurance policy, they may have a look at your age, wellness heritage, and Life-style choices. For automobile insurance, the make and product of your car, your driving heritage, as well as your place all occur into Participate in. Rates are essentially the expense of transferring risk from you to your insurance company, and the more chance you present, the upper your top quality could be.

Among the initial factors to be familiar with is how insurance plan premiums are calculated. Insurers acquire numerous variables into account when deciding the amount you’ll fork out every month. For health and fitness insurance policy, they may have a look at your age, wellness heritage, and Life-style choices. For automobile insurance, the make and product of your car, your driving heritage, as well as your place all occur into Participate in. Rates are essentially the expense of transferring risk from you to your insurance company, and the more chance you present, the upper your top quality could be.It’s also crucial to grasp deductibles. A deductible is the quantity you have to fork out away from pocket before your coverage coverage kicks in. For instance, Should you have a wellbeing insurance policies plan having a $one,000 deductible, you’ll need to pay back the 1st $1,000 of medical bills on your own. After that, your insurance policies can help deal with additional costs. Deductibles may vary dependant upon the type of insurance policies and the particular policy you end up picking. A lot of people select increased deductibles in exchange for lower rates, while others like lower deductibles for more immediate protection.

When thinking about insurance plan, it’s important to know the distinction between what’s included and what’s not. Not all predicaments are protected by each and every coverage. As an example, homeowners insurance plan typically covers damages from hearth or vandalism, nonetheless it won't include damages from a flood or an earthquake. If you live in a location liable to flooding, you could require to get additional flood insurance coverage. This concept of exclusions—what isn’t protected by a policy—is amongst the trickiest elements of coverage.

For people of us who rely on our automobiles to obtain from stage A to stage B, comprehending auto insurance plan the fundamentals is critical. Auto insurance plan is needed by legislation for most states, even so the protection it offers will vary extensively. Legal responsibility insurance, by way of example, covers damages to other people or residence for those who’re at fault in a mishap. Collision insurance plan aids restore or exchange your motor vehicle if It is really harmed in a crash, even though complete insurance policies addresses non-collision activities like theft, vandalism, or purely natural disasters.

But don’t be fooled into believing that all coverage companies are exactly the same. While they could give similar guidelines, diverse suppliers may have unique policies, pricing buildings, and customer service reputations. It’s essential to store around and Review insurance policies before committing. A few minutes of investigation could save you a major amount of cash in rates or enable you to come across a lot more comprehensive coverage for your needs.

Let’s shift gears and discuss life insurance Get Insights policy. Life insurance coverage isn’t only for older men and women or People with dependents—it’s a valuable Device for anyone seeking to protect their family and friends monetarily. If a thing have been to happen to you, life coverage presents a lump-sum payment to your beneficiaries. This tends to assist protect funeral charges, debts, and day-to-day residing prices. There are two most important sorts of everyday living insurance policies: expression and everlasting. Phrase life insurance policies handles you for a certain time period, whilst long lasting existence insurance policies delivers lifelong protection and may even accumulate hard cash value after some time.

When thinking about life coverage, look at what would materialize if you were being not all over. Would your family be able to spend the home loan or find the money for to send the kids to school? Would they wrestle with day-to-working day dwelling costs? By acquiring life coverage, you’re ensuring that Your loved ones gained’t be still left with monetary hardship from the deal with of an presently emotional and complicated circumstance.

Among the most normally forgotten sorts of insurance policies is disability insurance coverage. In the event you turn out to be not able to work due to ailment or injuries, incapacity insurance policies gives a part of your profits that will help keep you afloat. It’s very easy to think that it received’t take place to us, but the truth is that incidents and health problems can strike anyone at any time. Acquiring incapacity insurance coverage ensures that you received’t be fiscally devastated if you are struggling to do the job for an prolonged period of time.

Knowing the fundamentals of insurance policies can look overwhelming at the outset, but when you break it down, it’s easier to see The larger image. The key purpose of coverage is to give you assurance. By understanding you have protection in position, you'll be able to Are living your daily life with less worry of your mysterious. It’s about currently being geared up to the unanticipated and being aware of that there’s a security Internet to catch you in case you drop.